Some Of Transaction Advisory Services

Wiki Article

The Ultimate Guide To Transaction Advisory Services

Table of ContentsTransaction Advisory Services Can Be Fun For AnyoneAll About Transaction Advisory ServicesThe 6-Second Trick For Transaction Advisory ServicesThe Ultimate Guide To Transaction Advisory Services10 Simple Techniques For Transaction Advisory Services

This step makes certain the business looks its ideal to potential buyers. Obtaining business's worth right is essential for a successful sale. Advisors utilize different techniques, like discounted capital (DCF) analysis, comparing to comparable business, and recent transactions, to identify the fair market price. This helps establish a fair price and discuss successfully with future purchasers.Purchase consultants action in to help by obtaining all the needed details organized, responding to inquiries from purchasers, and setting up sees to the business's place. Purchase advisors use their competence to help organization owners take care of challenging settlements, fulfill buyer expectations, and framework bargains that match the owner's objectives.

Meeting legal policies is critical in any company sale. Transaction advisory services function with legal experts to create and assess agreements, contracts, and various other lawful documents. This decreases dangers and sees to it the sale follows the legislation. The function of purchase experts extends beyond the sale. They help company owner in planning for their following actions, whether it's retirement, starting a new venture, or handling their newly found wide range.

Transaction advisors bring a wealth of experience and knowledge, making sure that every element of the sale is managed properly. With calculated preparation, appraisal, and negotiation, TAS helps organization proprietors accomplish the highest possible price. By making certain lawful and governing compliance and managing due diligence along with other offer team members, transaction consultants minimize possible dangers and liabilities.

An Unbiased View of Transaction Advisory Services

By comparison, Big 4 TS groups: Deal with (e.g., when a possible customer is carrying out due persistance, or when an offer is shutting and the purchaser requires to incorporate the business and re-value the vendor's Equilibrium Sheet). Are with fees that are not linked to the deal closing effectively. Gain charges per involvement somewhere in the, which is less than what investment banks make even on "little bargains" (yet the collection possibility is likewise a lot greater).

The meeting inquiries are extremely comparable to financial investment financial meeting inquiries, yet they'll concentrate extra on audit and appraisal and much less on topics like LBO modeling. For instance, anticipate questions regarding what the Change in Working Capital methods, EBIT vs. EBITDA vs. Internet Income, and "accounting professional just" topics like trial balances and how to stroll through events making use of debits and credits as opposed to economic declaration changes.

9 Simple Techniques For Transaction Advisory Services

that demonstrate just how both metrics have transformed based on items, networks, and clients. to evaluate the accuracy of monitoring's previous forecasts., including aging, inventory by product, ordinary degrees, and arrangements. to figure out whether they're totally fictional or rather credible. Specialists in the TS/ FDD groups may also interview monitoring concerning everything above, and they'll create a detailed record with their searchings for at the end of the process., and the basic form looks like this: The entry-level role, where you do a whole lot of data and economic analysis (2 years for a promo from right here). The following level up; comparable work, yet you obtain the more fascinating little bits (3 years for a promo).

Specifically, it's challenging to obtain promoted beyond the Supervisor level since couple of people leave the work at that stage, and you require to begin showing proof of your capacity to create income to breakthrough. Let's begin with the hours and way of living because those are easier to explain:. There are periodic late nights and weekend work, however absolutely nothing like the frenzied nature of financial investment banking.

There are cost-of-living adjustments, so anticipate reduced settlement if you're in a less costly area outside significant monetary (Transaction Advisory Services). For all placements other than Companion, the base income makes up the mass of the complete compensation; the year-end benefit may be a max of 30% Transaction Advisory Services of your base pay. Frequently, the most effective means to enhance your revenues is to switch to a various company and work out for a higher wage and benefit

The 9-Second Trick For Transaction Advisory Services

You might enter business development, however financial investment banking obtains extra tough at this stage since you'll be over-qualified for Analyst functions. Corporate money is still an option. At this phase, you need to simply remain and make a run for a Partner-level function. If you wish to leave, perhaps transfer to a client and do their appraisals and due persistance in-house.The major issue is that because: You normally require to join an additional Big 4 team, such as audit, and work there for a couple of years and afterwards relocate right into TS, work there for a few years and afterwards relocate right into IB. And there's still no guarantee of winning this IB function due to the fact that it depends upon your area, clients, and the employing market at the time.

Longer-term, there is likewise some risk of and due to the fact that examining a company's historic monetary information is not specifically rocket scientific research. Yes, people will certainly constantly need to be involved, however with advanced innovation, lower head counts can potentially support customer involvements. That stated, the Purchase Services team defeats audit in regards visit their website to pay, work, and departure possibilities.

If you liked this article, you may be curious about analysis.

Rumored Buzz on Transaction Advisory Services

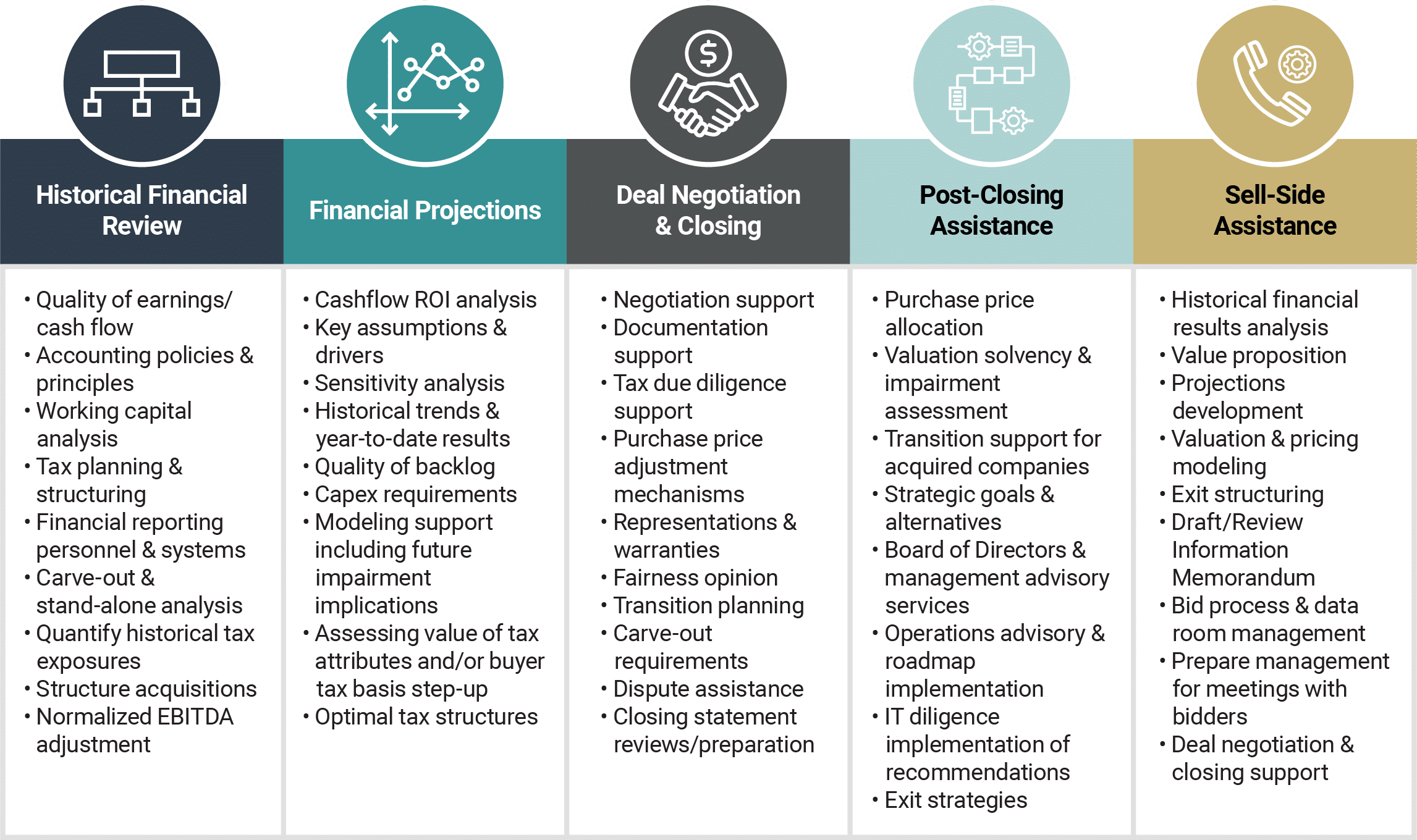

Establish advanced financial frameworks that assist in figuring out the real market price of a company. Supply advisory operate in relation to organization appraisal to aid in bargaining and prices structures. Describe one of the most appropriate kind of the deal and the type of factor to consider to employ (cash, supply, earn out, and others).

Do assimilation planning to identify the process, system, and business adjustments that may be required after the offer. Establish standards for incorporating divisions, innovations, and organization processes.

Identify potential reductions by decreasing DPO, DIO, and DSO. Evaluate the prospective Homepage client base, industry verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance supplies vital insights into the performance of the firm to be obtained worrying threat analysis and value creation. Identify short-term modifications to finances, banks, and systems.

Report this wiki page